Pioneering Actionable Intelligence for Mortgage

Industry Challenge

Despite technological advancements, the mortgage industry still faces significant challenges in managing loan data and documents efficiently. This leads to inefficiencies in classifying, indexing, extracting, and validating data, impacting the orchestration of jobs and services throughout a loan's lifecycle.

Innovative Solution

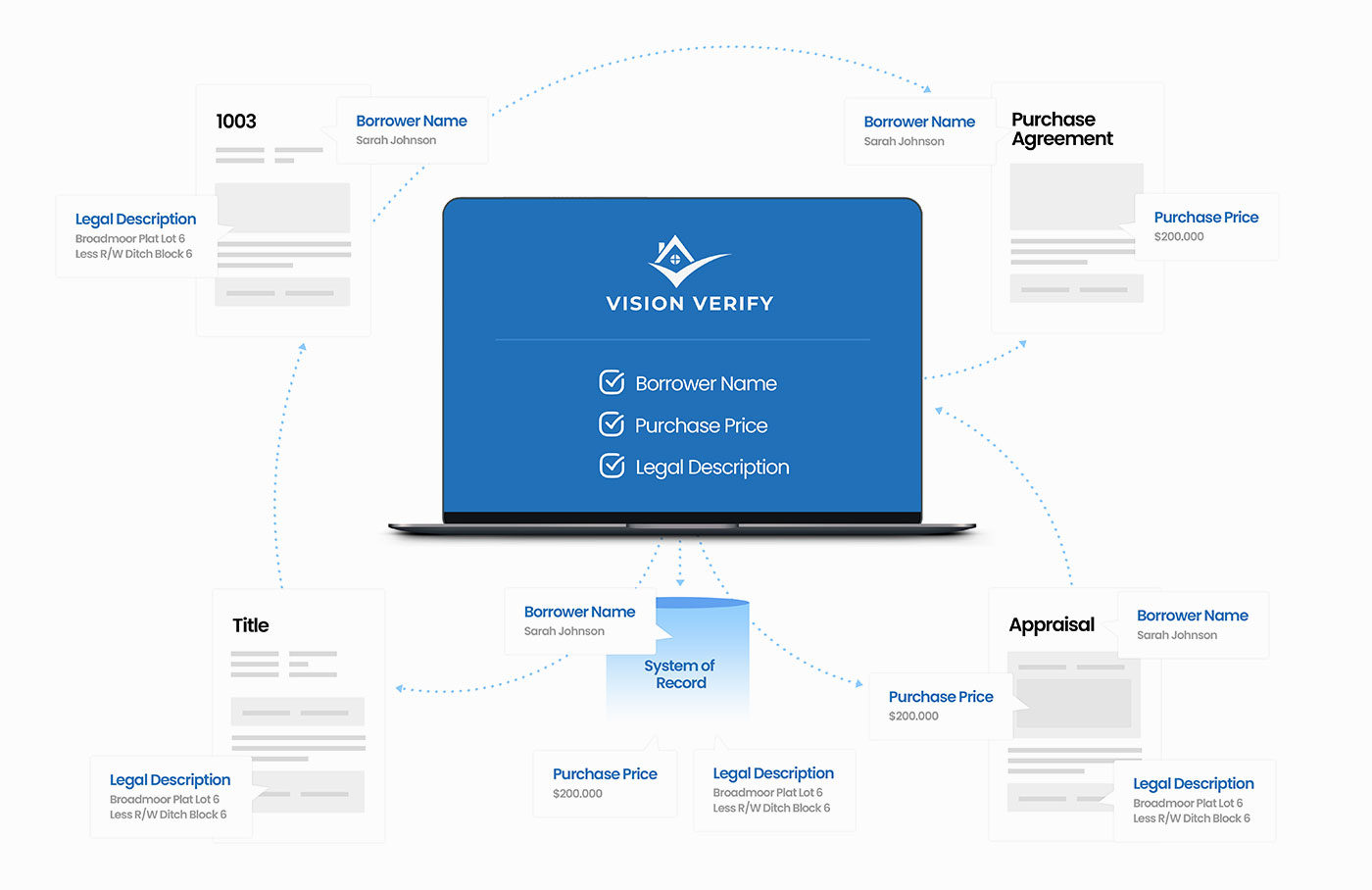

Vision Verify offers a revolutionary low-code/no-code utility, taking the step beyond data extraction tools and technology. This solution innovates beyond mere loan management by reducing the “human in the loop” requirements that have stalled the industry for decades.

Actionable Intelligence

Actionable Intelligence is the valuable, practical insights derived from analyzing and interpreting data and information. In the context of Vision Verify, it specifically means the orchestration of tasks related to processing, validating, and resolving data extracted from source systems and various documents. This intelligence is not just informative but is structured and presented in a way that either directly facilitates or supports decision-making and operational actions.

Capabilities

- Connect to source system(s)

- Classify, index, file, and version documents

- Identify missing pages and/or documents

- Extract data from documents

- Validate extracted data based on Source of Truth

- Create and schedule pre-built jobs

- Create and schedule pre-built services

- Automatically resolve inconsistencies in data

The Opportunity

Vision Verify enhances the capabilities of data extraction tools and technology, transforming extracted data into actionable intelligence. It offers advanced processing and resolution tools, designed for utmost precision and efficiency, thereby elevating the existing data management ecosystem.

-

Cost Efficiency

Automate data tasks to significantly reduce operational costs, allowing for resource reallocation to strategic areas.

-

Risk Reduction

Mitigate risks through precise data reconciliation and validation, ensuring data integrity and regulatory compliance. areas.

-

Scalability

Easily manage growing data volumes with Vision Verify's adaptable and scalable solutions, ensuring efficiency regardless of data complexity.

-

Innovation

Lead in innovation with AI-driven data management, differentiating your business and gaining a competitive edge.

-

Agility

Rapidly convert data into actionable insights, enhancing decision-making speed and market responsiveness. -

Transformation

Embrace Vision Verify to transform data management from a routine task to a strategic asset, driving growth and innovation.

Jobs

Jobs that automate various processes in the life of a loan can be pre-built and scheduled. A job consists of validated data and documents that are required to perform a task, for example:- Collateral Review

- Lien Release

- Loan Acquisition (Flow or Bulk)

- Loan Sale-Delivery

- Loan Onboarding

- MSR Sale-Acquisition

- New Loan Set-Up (Servicing)

- Pre-Close QC

- Post-Close QC

- Securitization

- Trailing-Final Docs

- Warehouse Funding & Custody

Services

Simplify and automate the delivery of validated data and documents for various services:- Appraisal

- Due Diligence

- Flood

- Fraud

- Investor Delivery

- Mortgage Insurance

- Quality Control

- Tax Certification

- Tax Transcript

- Title

- Verifications

- Warehouse